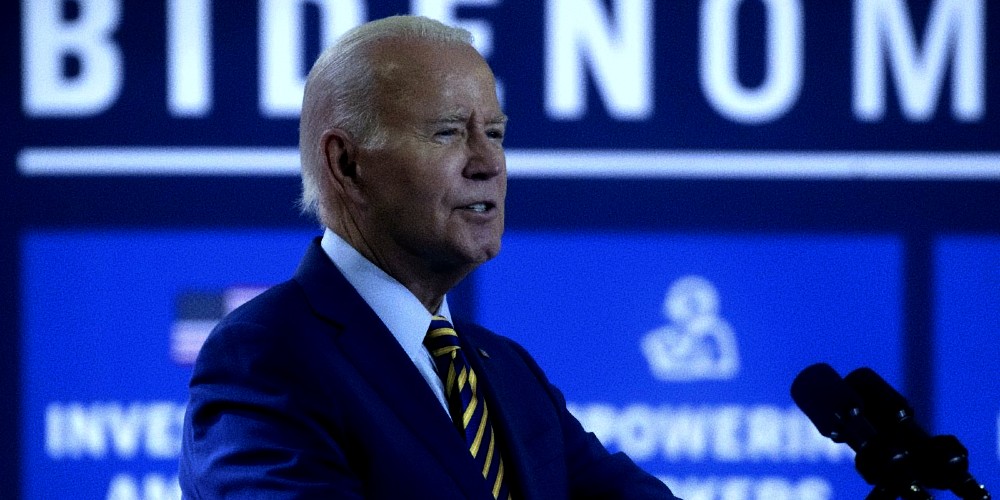

(Zero Hedge)—It has become a running joke: the “strong” Bidenomics economy comes with an expiration date, as it is only “strong” for about a month, at which point the initial “strength” is downgraded, and the data is revised sharply lower.

That has certainly been the case with US labor data, where as we first reported last month, every single monthly payrolls print in 2023 has been revised lower (see chart below), a 12-sigma probability and virtually impossible unless there was political pressure to massage the data higher initially and then revise it lower when nobody is looking.

But the BLS is not done: as we reported last week, besides the now traditional one-month lookback revisions the ridiculously high monthly payrolls prints accumulated over the past year will also be slowly but surely revised gradually lower at annual benchmark revisions for years to come. As Morgan Stanley chief US economist Ellen Zentner explained (full note available to pro subscribers)…

Payrolls get revised too, and we expect a downward revision. Payrolls have an annual benchmark revision that is published in February each year. The revision adjusts the level of payrolls through March of the prior year. For example, a new revision will be published in Feb-24, adjusting payroll levels from April-22 to Mar-23. And a preliminary estimation of the upcoming revision points to a decrease in payroll YoY% growth rates of -0.2pp.

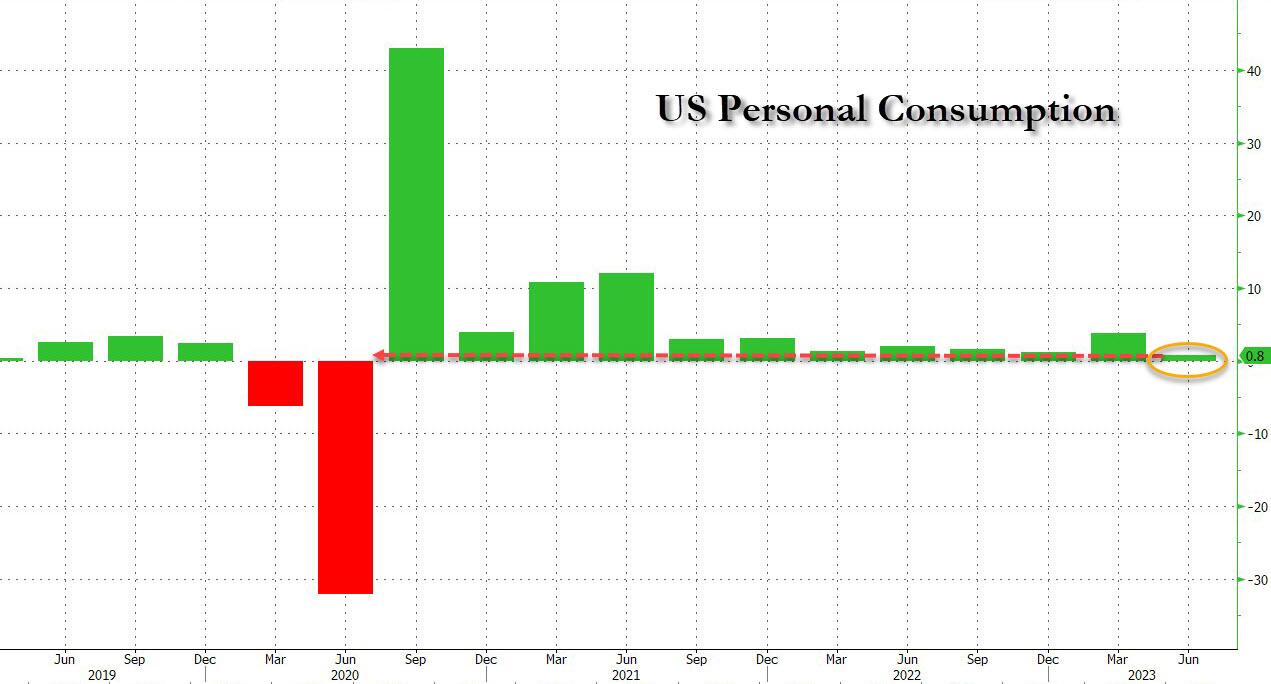

But while downward payroll revisions under Bidenomics are as certain as death and taxes, what we wanted to discuss here are the just as striking downward revisions to US consumption which hit this morning alongside the comprehensive once every-five-years historical revisions to GDP. As a reminder:

Today’s release presents results from the comprehensive update of the National Economic Accounts (NEAs), which include the National Income and Product Accounts (NIPAs) and the Industry Economic Accounts (IEAs). The update includes revised statistics for GDP, GDP by industry, GDI, and their major components. Current-dollar measures of GDP and related components are revised from the first quarter of 2013 through the first quarter of 2023. GDI and selected income components are revised from the first quarter of 1979 through the first quarter of 2023.

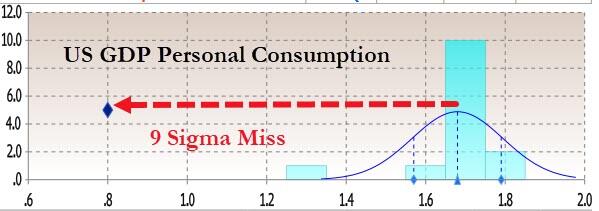

Earlier today we already noted the disaster that was Q2 Personal Consumption: instead of the 1.7% unchanged print from the second estimate of Q2 GDP, the final number was a dire 0.8%, a 9-sigma miss to estimates…

But what about other historical data? After all today’s revision impacted all data from Q1 2013? Therein, as the bard says, lies the rub.

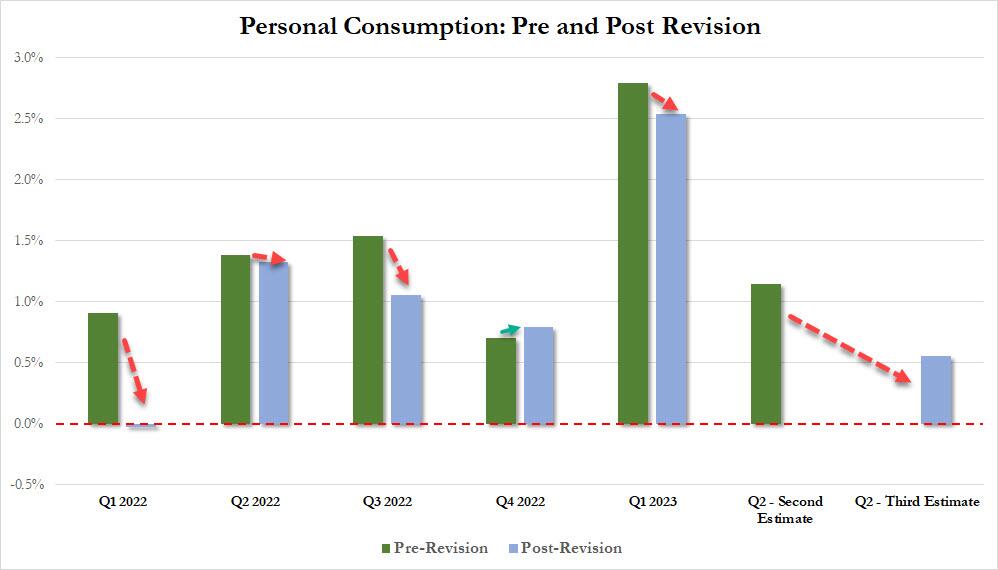

Let’s start with personal consumption, and compare the latest post-revision current data (link) with the most comprehensive pre-revision data as of last month (link). It should come as no surprise to anyone that with the (slight) exception of just Q4 2022, personal consumption in every single quarter since the start of 2022 – when the Fed aggressively started tightening and hiked rates by the most since Volcker – has been revised lower, and in some cases dramatically so.

Bloomberg also picks up on the GDP revision and looking at revisions to the historical data, writes that “the pandemic contraction is seen as being a bit less severe than previously thought: GDP is now reckoned to have dropped at a 28% annual clip in the second quarter of 2020, instead by 29.9%, as the government shut down swathes of the economy to fight the spread of the virus. But the recovery since then has been somewhat slower, according to the update. Growth last year was revised to 1.9% from 2.1%.” And of all GDP components, consumption was the weakest.

So not only was the Fed hiking at a time when personal consumption would grow much less period to period than previously expected, but the US economy was generally weaker than previously expected (as discussed here).

There’s more.

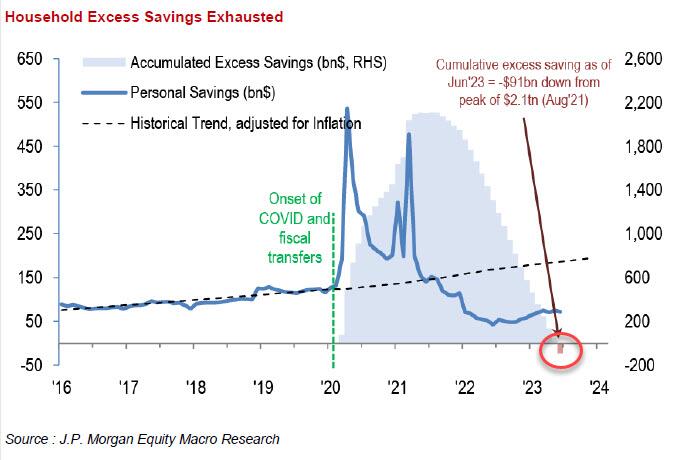

When looking at the composition of the US household’s income statement – the summary of economic accounts – we find just what we had expected: US savings were in fact far lower than previously expected.

In the latest negative revision, US households saved $1.1 trillion less than previously thought over the past six years…

… and indeed as the BEA chart below shows, Americans stashed away an average 8.3% of their disposable income annually from 2017 through 2022, down from a previously estimated 9.4%.

The reduction stems from an accounting adjustment that lowered personal income from mutual funds and real estate investment trusts. Additionally, as Bloomberg notes, much of the reduction in personal savings seen in the revised data occurred prior to the pandemic, so its implications for how much extra cash Americans may feel they still have now is not clear cut.

Whatever the reason for the statistical adjustment, however, one can say goodbye to even the faintest speculation that US households have any excess savings left… why they don’t, of course, because even when using the previous methodology which artificially inflated total savings, JPM calculated that excess savings had already run out…

… which means that if Q3 GDP was bad and consumption was “revised” sharply lower (odd how economic data is never revised higher under Joe BIden), Q4 – when savings are virtually non-existant – and where we also get the i) return of student loan payments; ii) the UAW strike; iii) the government shutdown and iv) oil at almost $100 and gasoline at one year highs, is about to fall off a cliff.

Three Reasons a Coffee Gift Set From This Christian Company Is Perfect for Christmas

When you’re searching for a Christmas gift that’s meaningful, useful, and rooted in faith, you don’t want to settle for anything generic. This season is filled with noise — mass-produced products, last-minute picks, and trends that fade as quickly as they appear. But one gift stands apart because it blends genuine quality with a message that matters: a coffee gift set from Promised Grounds Coffee.

This small Christian-owned company has become a favorite among believers who want to support faith-driven businesses while giving friends and family something they’ll actually enjoy. Here are three reasons a Promised Grounds Coffee gift set may be the most thoughtful and impactful present you give this year.

1. It’s Truly Delicious Coffee

Too many “gift-worthy” coffees look beautiful in the package but disappoint when the cup is poured. Promised Grounds takes the opposite approach — exceptional taste first, thoughtful presentation second.

Their beans are sourced with care, roasted in small batches, and crafted to bring out a rich, smooth flavor profile that appeals to both casual drinkers and true coffee lovers. Whether someone enjoys bold, dark roasts or lighter, more delicate blends, every sip reflects quality that stands shoulder-to-shoulder with the biggest specialty brands.

Simply put: this coffee is good. Really good. Some say it’s absolutely fantastic. If you want a gift that won’t be re-gifted, ignored, or shoved in a cabinet, this is it.

2. It Spreads the Word While Serving a Real Purpose

There are many Christian gifts that are meaningful… but not exactly practical. There are also useful gifts that have nothing to do with faith. Promised Grounds Coffee bridges both worlds beautifully.

Each gift set delivers an encouraging, faith-centered message through its packaging and presentation — a simple but powerful reminder of God’s goodness during the Christmas season. The cups are especially popular and serve as a daily reminder of the blessings from our Lord. At the same time, the product itself is something people will actually use and appreciate every single day.

It’s a gift that uplifts the spirit and fills the mug. A gift that points loved ones toward Scripture while still being part of the normal rhythm of life. And in a culture that increasingly pushes faith to the margins, giving a gift that quietly but confidently honors Christ can make a deeper impact than you might expect.

3. It’s Affordable, Valuable, and Elegantly Presented

Many people want to give something meaningful without breaking their Christmas budget. Promised Grounds Coffee strikes that perfect balance — the sets look and feel premium, but the price remains accessible.

The packaging is classy, clean, and gift-ready, making it ideal for:

- Family members of all ages

- Co-workers or employees

- Church friends or small-group leaders

- Hosts, neighbors, and last-minute gift needs

It’s the kind of gift that feels more expensive than it is — and more thoughtful than most of what you’ll find on store shelves.

The Perfect Blend of Faith, Flavor, and Christmas Cheer

A coffee gift set from Promised Grounds Coffee checks every box: a gift that tastes amazing, conveys your faith, supports a Christian business, and brings daily enjoyment to the person who receives it. In a season when so many gifts are forgotten, this one stands out for all the right reasons.

If you want a Christmas present that reflects your values and delivers genuine joy, Promised Grounds Coffee is the perfect place to start.

Shockingly democrats’ approach of fighting inflation with more inflationary measures hasn’t worked, for some odd reason, and I mean that as sarcastically as humanly possible. Meanwhile, as democrats are focused on getting their donors 40% pay raises, reduced work hours, fat pensions, with lots of dues redirected back to the DNC, the poor and those on a fixed income, such as seniors, are being slammed, and spend most of their days wondering where their next meal is coming from. Buying power is half what it was before. Everyone in the country has basically taken a 50%+ pay cut. The fed has lost control. It can’t be fixed by monetary policy, or manipulating rates. Government has squeezed the turnip dry. It isn’t sustainable. There’s little question it’s going to implode. The only question is when.

Dis wat communists du.

Stop buying anything but your essentials. Let the economy feel the biden.