(Zero Hedge)—The so-called “debasement trade” into gold and Bitcoin is “here to stay” as investors brace for persistent geopolitical uncertainty, according to a Jan. 3 research note by JPMorgan shared with CoinTelegraph.

Gold and BTC “appear to have become more important components of investors’ portfolios structurally” as they increasingly seek to hedge against geopolitical risk and inflation, the bank said, citing the “record capital inflow into crypto markets in 2024.”

The debasement trade refers to increasing demand for gold and BTC due to factors ranging from “structurally higher geopolitical uncertainty since 2022, to persistent high uncertainty about the longer-term inflation backdrop, to concerns about ‘debt debasement’ due to persistently high government deficits across major economies,” among others, JPMorgan said.

Institutional inflows

Investment managers including Paul Tudor Jones are longing Bitcoin and other commodities on fears that “all roads lead to inflation” in the United States.

US state governments are also adding Bitcoin as “a hedge against fiscal uncertainty,” asset manager VanEck said in December.

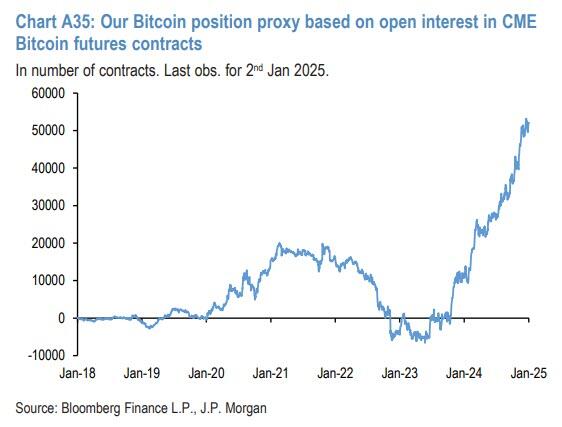

In October, JPMorgan cited spiking open interest on BTC futures as another indicator that “funds might see gold and Bitcoin as similar assets.”

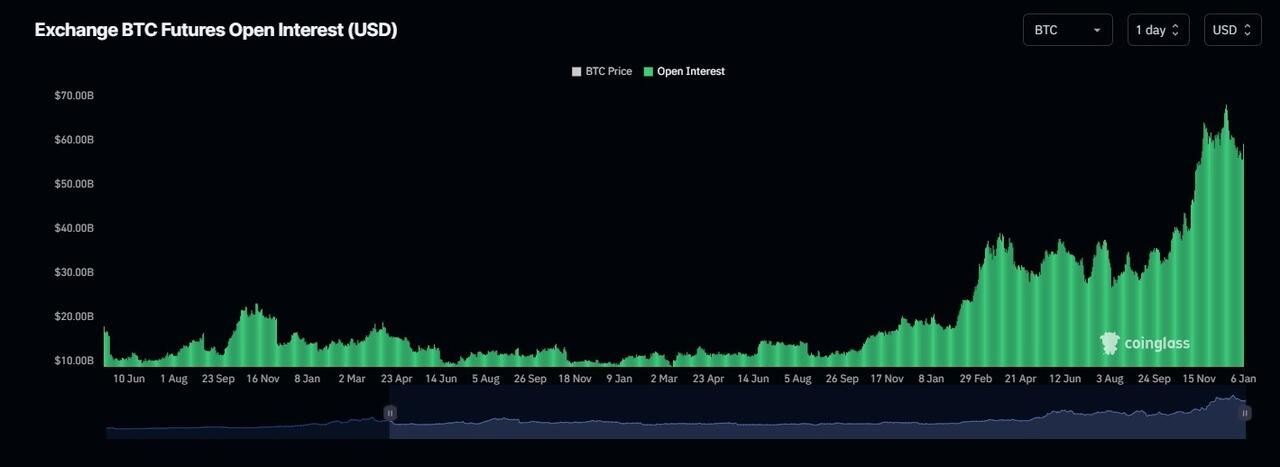

In 2024, net open interest on BTC futures rose from approximately $18 billion in January to upward of $55 billion in December, according to data from CoinGlass.

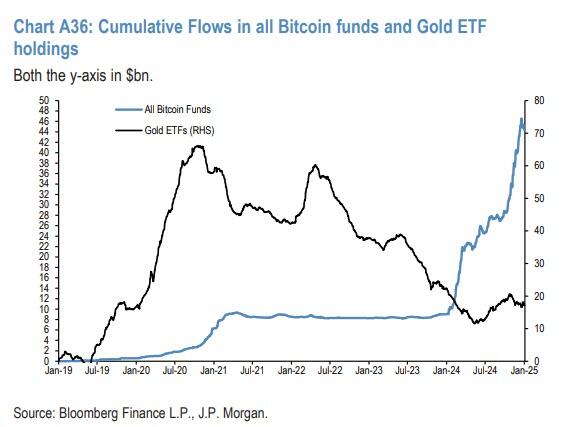

“In addition, the fact that Bitcoin [exchange-traded funds] started seeing inflows again in September after an outflow in August suggests that retail investors might also see gold and Bitcoin in a similar fashion,” JPMorgan said in October.

In November, US Bitcoin ETFs broke $100 billion in net assets for the first time, according to data from Bloomberg Intelligence.

Crypto ETF inflows are among the most important metrics to watch because they are “more likely than other trading activity to be new funds/market participants entering the crypto space,” according to a December report by Citi shared with Cointelegraph.

Surging institutional inflows could cause positive “demand shocks” for Bitcoin, potentially sending BTC’s price soaring in 2025, asset manager Sygnum Bank said in December.

* * *

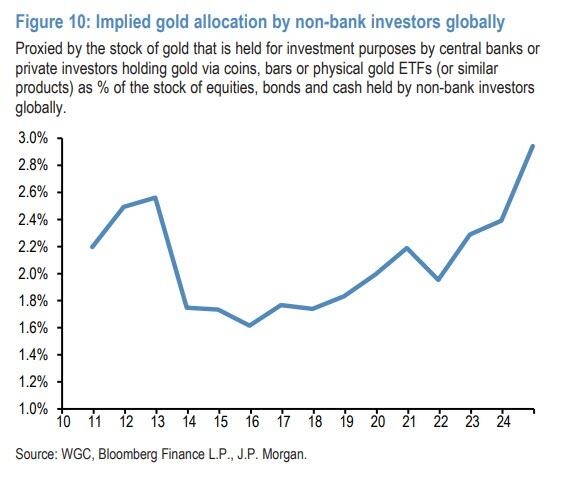

[ZH: The structural rise of gold in investors’ portfolios is best shown in the chart below, which proxies gold allocation globally via the stock of gold that is held for investment purposes by central banks or private investors holding gold via coins, bars or physical gold ETFs (or similar products) as % of the stock of equities, bonds and cash held by non-bank investors globally.

Controlling Protein Is One of the Globalists’ Primary Goals

Between the globalists, corporate interests, and our own government, the food supply is being targeted from multiple angles. It isn’t just silly regulations and misguided subsidies driving natural foods away. Bird flu, sabotaged food processing plants, mysterious deaths of entire cattle herds, arson attacks, and an incessant push to make climate change the primary consideration for all things are combining for a perfect storm to exacerbate the ongoing food crisis.

The primary target is protein. Specifically, they’re going after beef as the environmental boogeyman. They want us eating vegetable-based proteins, lab-grown meat, or even bugs instead of anything that walked the pastures of America. This is why we launched a long-term storage prepper beef company that provides high-quality food that’s shelf-stable for up to 25-years.

At Prepper All-Naturals, we believe Americans should be eating real food today and into the future regardless of what the powers-that-be demand of us. We will never use lab-grown beef. We will never allow our cattle to be injected with mRNA vaccines. We will never bow to the draconian diktats of the climate change cult.

Visit Prepper All-Naturals and use promo code “veterans25” to get 25% off plus free shipping on Ribeye, NY Strip, Tenderloin, and other high-quality cuts of beef. It’s cooked sous vide, then freeze dried and packaged with no other ingredients, just beef. Stock up for the long haul today.